Fast and Efficient

Turn Missed Payments into Recovered Revenue

AI-powered voice recovery that reaches customers early, follows up with empathy, and drives faster results — all under your brand.

- Recover up to 2 - 3× more than traditional methods.

- No subscriptions or hidden costs - pay only on results.

- 100% compliant, customer-friendly approach.

Profit is strategy. Cashflow is survival

Recovery. Re-imagined

Cleveri combines AI voice agents and human recovery experts to help lenders re-engage overdue customers early — before debts turn into defaults.

We contact your customers in your brand’s name, detect intent and emotion, and guide them to resolution — automatically and empathetically.

You get faster recoveries, stronger relationships, and no compliance headaches.

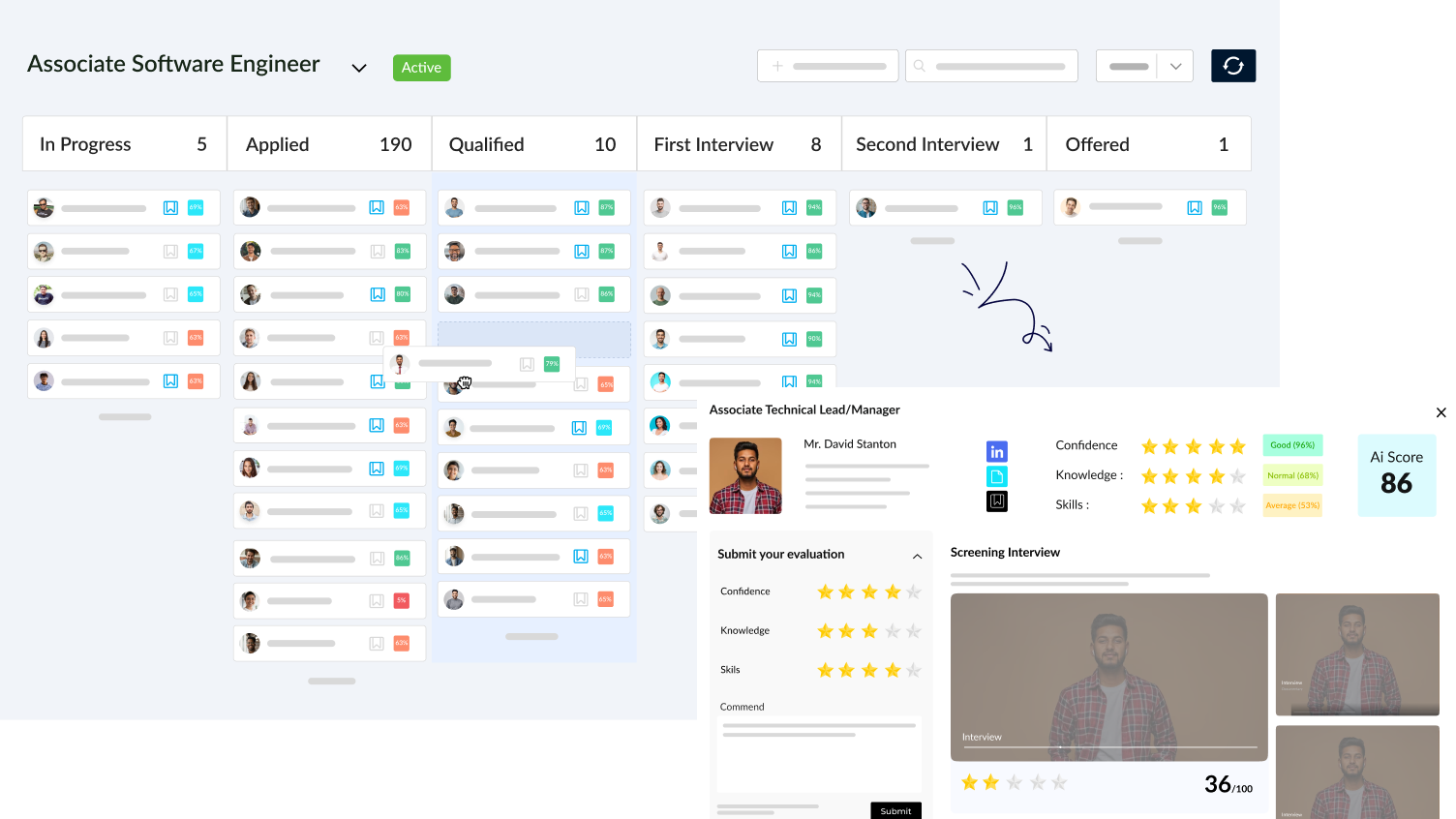

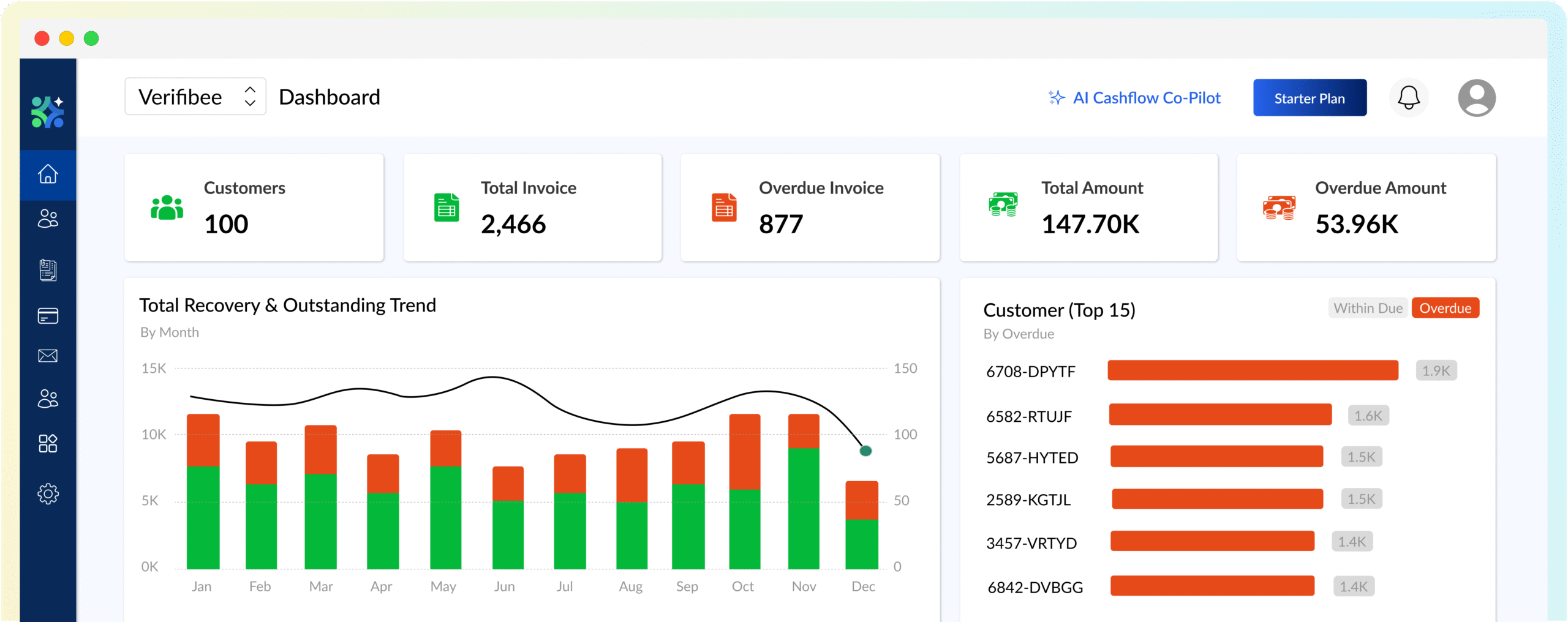

Meet Cleveri Cashflow Copilot

Smarter Recovery. Seamless Experience

We combine intelligent automation and human care to recover payments efficiently — without adding workload or risking compliance.

It’s the world’s first Cashflow Copilot - combining AI precision, human care & expertise, and intelligent automation into a single platform.

Simple setup. Seamless operation.

From Missed to Paid — In Days, Not Months.

Cleveri connects to your existing systems, engages customers through AI-driven voice calls, and delivers results — all under your brand and compliance framework.

01.

Connect Your System

Integrate securely with Xero, QuickBooks, Sage, or your bank through TrueLayer.

No complex setup — your data syncs automatically and stays fully protected.

-

Integrations with Xero, QuickBooks, Sage Intacct, and more

-

Connect to any UK or EU bank via TrueLayer

-

Optional CSV upload for manual lists or smaller portfolios

02.

Set Your Rules

You decide the tone, payment options, and escalation limits.

Cleveri follows your compliance standards and speaks in your brand’s voice.

-

Configure payment plan options and retry intervals

-

Define brand tone, call frequency, and communication windows

-

Apply regulatory or policy rules unique to your organisation

03.

AI Engages Members

Our voice AI reaches customers under your name, detecting emotion and intent in real time.

It starts meaningful conversations — not robotic reminders.

-

Emotion-aware voice calls with adaptive tone and empathy

-

Detects intent, willingness, and urgency automatically

-

Operates 24/7, contacting customers at the best response times

04.

Humans Step In (When Needed)

When cases require empathy or negotiation, our recovery specialists take over seamlessly.

They’re guided by AI insights, ensuring every follow-up is informed and respectful.

-

Experienced recovery agents handle escalations under your brand

-

Full context hand-off with AI sentiment and call summary

-

Maintain customer trust with respectful, compliant conversations

05.

You See Results

Recovered payments go directly into your account — no middle steps or delays.

You’ll have full visibility with transparent reports and performance analytics.

-

Real-time dashboard with calls, payments, and recovery metrics

-

Automated reconciliation with your accounting or bank data

-

Downloadable reports for compliance and internal review

Predictable Costs. Proven Returns

Only Pay for Real Recoveries

No subscriptions or hidden costs - just transparent, performance-based pricing that rewards results. Start small with a low-commitment plan or grow with a dedicated partnership built for continuous growth.

Starter Plan

Best for small portfolios or early adopters.

Monthly minimum commitment £299.

*6-10% Success Fee

- Integration with QuickBooks, Xero, & Clio

- Connect with any Banks in UK/EU

- Optional CSV upload for smaller portfolios

- AI-Driven Risk Scoring

- AI-Driven chasing unpaid invoices

- Auto Reconciliation

- Credit Monitoring

Growth Plan

Best for mid-size credit providers.

Monthly minimum commitment £999.

*3-8% Success Fee

Continuous recovery with lower fees and dedicated support for the teams managing growing monthly arrears and recurring campaigns.

- All the Features in the Starter Plan

- Integration with QuickBooks, Xero, Clio & ect..

- Connect with any Banks in UK/EU

- Multi-channel (voice, SMS, email) engagement

- Dedicated Account Manager

- Escalations to Human Agents **

- Standard Reports

Partner Plan

Best for large financial institutions

Monthly minimum commitment £1,999.

*2-6% Success Fee

Enterprise portfolios requiring compliant, high-touch recovery. Dedicated support and deeply customisable AI workflow and AI Agents.

- All the Features in the Growth Plan

- Connect with any Banks in UK/EU

- Custom Integration with Accounting, CRM, & Communication Systems

- Custom AI Tone, Scripts

- AI-Prioritized Worklists

- SLA-based Reports

** When escalation is required, our trained agents work under your brand and supervision — combining empathy, compliance, and professional communication at every step.

Built for Trust. Backed by Compliance

Your data privacy is

our top priority

Cleveri operates under the highest data security standards.

We are ISO 27001, SOC 2 certified, and GDPR compliant with strict controls for encryption, access, and audit logging.

We operate within your FCA compliance framework and never hold funds.

Get started

Ready to Recover More?

Turning missed payments into meaningful conversations — powered by empathy, AI, and trust.

Launch a 30-day pilot and see what empathetic, AI-driven recovery can do for your portfolio.