Built on Recovery Co-Pilot

Custom Voice Workflows for Financial Teams

Need something beyond standard recovery flows? We design tailored voice workflows on the same core platform — so you extend capability without adding complexity.

- Designed in the UK

- Delivered globally

Cleveri Smart Solutions

Why Financial Teams Choose Cleveri

Cleveri builds custom Voice AI agents and workflows for fintech and businesses to handle recovery, servicing, risk escalation, and lead qualification at scale, with human-like conversations.

Use-case specific Voice AI agents

Every Voice AI agent is designed around your exact workflow, rules, and outcomes. No generic bots — only purpose-built agents that do one job extremely well.

Natural, human-like calls customers respond to

Our agents speak clearly, listen actively, and adapt to real conversations. They reduce resistance, improve response rates, and avoid robotic interactions.

Compliance-aware by design

AI agents clearly identify themselves, respect opt-outs, and follow call rules. Controls are built in to meet financial, privacy, and customer-care standards.

Rule-based escalation to human teams

When conversations go off-script, agents hand over to humans instantly. Your team only deals with exceptions, disputes, or sensitive cases.

UK-Based Strategy & Oversight

Led from the UK, built with our trusted engineering team, deliver globally with confidence and data protection.

Fast, Scalable, Affordable

We launch focused pilots in weeks, not months or quarters. Start small, prove value quickly, then scale with confidence.

WHAT WE DO

Speed to Leads & handle End to end application process

Our goal is to solve user problems by using a tailored and innovative approach that ultimately helps our clients achieve their objectives.

Lead Qualification (Financial Services)

Handle initial qualification calls, apply clear rules, and pass only suitable cases to human teams.

Common in: mortgage brokers, lenders, financial advisors

Risk & Fraud Escalation (Financial Services)

Reach customers quickly after risk events to confirm activity and escalate where required.

Common in: cards, payments, BNPL, fintech platforms

Loan Servicing & Account Support

Handle routine servicing calls such as payment queries, instalments, and balance checks.

Common in: lenders, subscription finance, servicing teams

Bespoke Recovery Scenarios

Custom recovery logic where standard workflows don’t apply - including staged escalation, sensitive segments, or partner-specific rules.

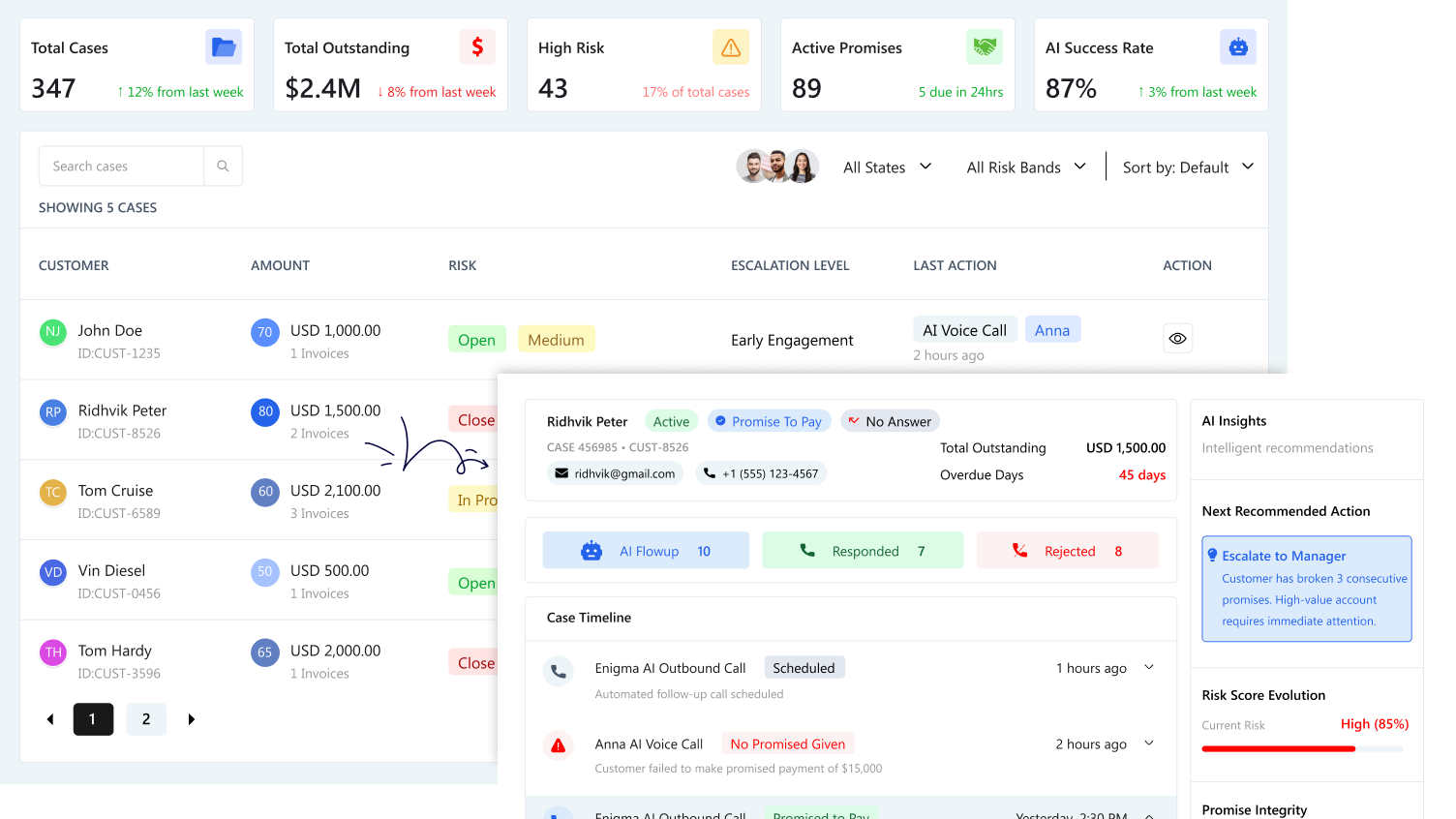

How This Fits With AI Recovery Co-Pilot

AI Recovery Co-Pilot remains the core product.

-

Same Conversation Use the same conversation engine

-

Better Escalations Integrate with the same reporting and escalation model

-

Same Controls Follow the same control and compliance principles

-

Eliminate Risks Avoids fragmented systems and inconsistent experiences

OUR APPROACH

Start Small, Collaborate, Deliver, and Scale

We start small, unravel the real challenges, and deliver value through a UK-led strategy backed by global engineering.

Our agile, collaborative approach keeps you closely involved from concept to launch.

Free Discovery Call with US

Understand your goals, pain points, and systems.

Rapid Prototyping / Scope Design

Get a lean, functional plan — not just theory.

Agile Build with Quality Delivery

We build quickly, you stay in the loop with Quality Delivery.

Launch, Support, and Evolve

Ongoing optimisation, iteration, and support

Let's Build What Works for You

If you’re using AI Recovery Co-Pilot and need to extend it - or want to explore a specific financial workflow - we’ll tell you clearly what’s feasible and what isn’t.